Pennsylvania

If you have Medicaid in Pennsylvania and want to change your insurance carrier, you can do it on line or over the phone. For more information, please visit this website.

Enroll | PA Enrollment Services (enrollnow.net)

Alternatively, you can call 1-800-440-3989

To enroll in Medicaid in Pennsylvania, use the Compass website. For a reference guide on the Compass application, click here.

If you have trouble logging into Compass, you can fill out a paper application and mail it in.

Pennie will refer pregnent women and children under the age of one to Medicaid if their income is below 220% of FPL. Also, it will refer older children to Medicaid if their household income is below 162% of FPL.

Pennie will refer children to no-cost CHIP if their family income is below 213% of FPL, and will refer children to low-cost CHIP if their family income is between 213% and 314% of FPL. Here is a chart of CHIP income guidelines for Pennsylvania.

CHIP guidlines for family of five according to March 1, 2023 chart

AGE__INCOME RANGE__PRICE

ages 6-18: $55,170 – $ 73,092 Free

ages 6-18 $ 46,737 – $ 73,092 Free

ages 0-1 $ 75,551 – $ 92,067 $53/mo

*ages 1-18 $ 73,092 – $ 92,067 $53/mo

ages 0-18 $ 92,067 – $ 101,204 $75/mo

ages 0-18 $ 101,204 – $ 110,340 $86/mo

ages 0-18 $ 110,340 – No Limit $235/mo

Medicaid and CHIP may be available for foreign nationals who have a Green Card, are asylees or refugees, have withholding of deportation status, or are parolees for at least the next year.

Here is information on Medical Assistance Benefits for Workers with Disabilities (MAWD)

For information on income and resource limits for seniors and disabled people, click here.

Ohio

If you have Medicaid in Ohio and want to change your insurance carrier, you can do it on line or over the phone. For more information, please visit this website or this website.

Alternatively, you can call 1-800-324-8680

Since February 2023, Ohio has required households with children to apply for Medicaid even with incomes somewhat above 138% of FPL. Applications on Healthcare.gov will be kicked over to Ohio Medicaid, unless the applicant has been recently denied Ohio Medicaid. For more information, please visit this webpage.

Virginia

If you have Medicaid in Virginia and want to change your insurance carrier, you can do it on line or over the phone. For more information, please visit this website.

Cardinal Care, Virginia’s Medicaid Program

Alternatively, you can call 1-833-522-5582

Illinois

Illinois Medicaid Eligibility for Long Term Care: Income & Asset Limits

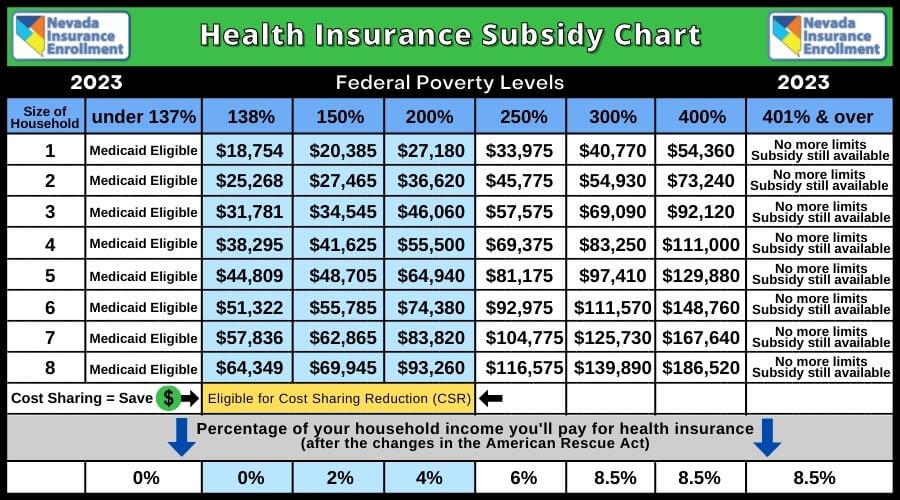

If you are not on Medicare, you can qualify for Medicaid in Pennsylvania and most other states if your household income is below 138% of federal poverty level (FPL). Here is a chart for FPL that will be in effect for the 2023 plan year:

This chart is from California, but all the information except for Medi-Cal is relevant across the country.

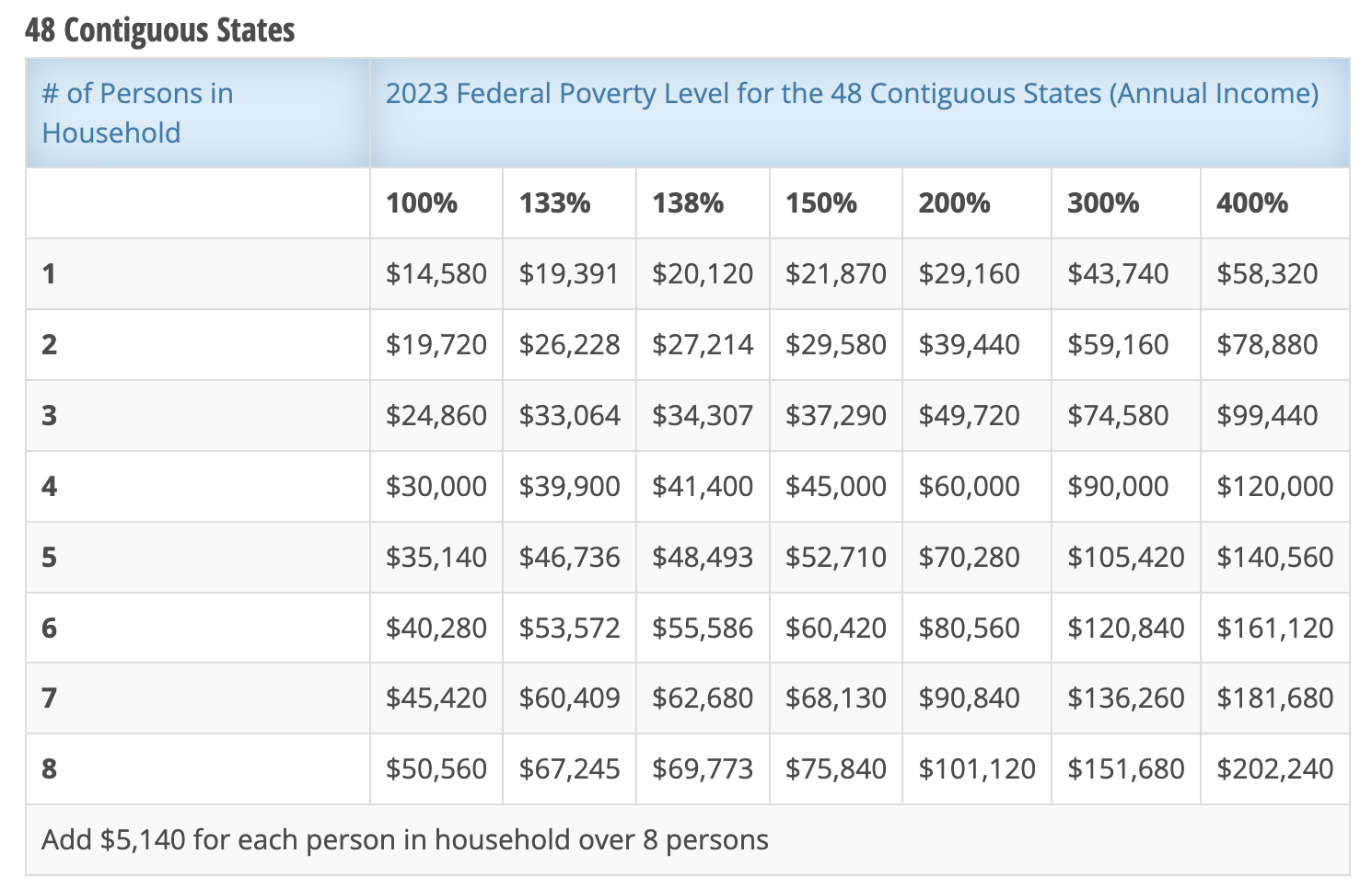

The chart below will apply to 2024 enrollments.

For people with Medicare, the income requirements for Medicaid are more stringent, plus there are asset limits as well. Moreover, there are different categories of Medicaid for people who also have Medicare.

| 2022 | ||||||||

| Family Size | 1 | 2 | ||||||

| PH 100% FPIG* | 1132 | 1525 | ||||||

| PH resource limit | 2000 | 3000 | NMP plus Medicare A, B, & D premiums, deductibles and copays | |||||

| PG – QMB 100% FPIG | 1132 | 1525 | Qualified Medicare Beneficiaries Cost Sharing | |||||

| PG resource limit | 8400 | 12600 | Covers A, B, D, deductibles and copays | |||||

| TA 65/TJ 65 – SLMB 120% FPIG* | 1359 | 1830 | Select Low Income Beneficiaries | Part B only/No ACCESS Card | ||||

| resource limit | 8400 | 12600 | ?? Covers A, B, D, deductibles and copays | |||||

| TA 67/TJ 67 – QI 135% FPIG* | 1528 | 2059 | Qualified Individuals | |||||

| QI resource | 8400 | 12600 | No diff. in coverage between SLMB & Q-I | |||||

| PW/PI – MAWD 250% FPIG* | 2831 | 3814 | Income test uses both husband and wife’s income | |||||

| MAWD Resource | 10000 | 10000 | Premium is 5% of individual’s net income only |

Medical Assistance

Eligibility Manual

Is there a reason why I would want to avoid Medicaid?

Estate Recovery

State Medicaid programs must recover certain Medicaid benefits paid on behalf of a Medicaid enrollee. For individuals age 55 or older, states are required to seek recovery of payments from the individual’s estate for nursing facility services, home and community-based services, and related hospital and prescription drug services. States have the option to recover payments for all other Medicaid services provided to these individuals, except Medicare cost-sharing paid on behalf of Medicare Savings Program beneficiaries.

Under certain conditions, money remaining in a trust after a Medicaid enrollee has passed away may be used to reimburse Medicaid. States may not recover from the estate of a deceased Medicaid enrollee who is survived by a spouse, child under age 21, or blind or disabled child of any age. States are also required to establish procedures for waiving estate recovery when recovery would cause an undue hardship.

States may impose liens for Medicaid benefits incorrectly paid pursuant to a court judgment. States may also impose liens on real property during the lifetime of a Medicaid enrollee who is permanently institutionalized, except when one of the following individuals resides in the home: the spouse, child under age 21, blind or disabled child of any age, or sibling who has an equity interest in the home. The states must remove the lien when the Medicaid enrollee is discharged from the facility and returns home. (from Estate Recovery | Medicaid)

Does Medicaid adversely affect immigration prospects?

Currently it does not. But it has in the recent past and it may in the future. For more information, refer to the article below.

Public Charge Ground of Inadmissibility final rule

Medicare Supplemental Insurance and Medicaid

Can the cost of Medicare supplement insurance premiums be used to reduce the income amount to gain eligibility? Or would I not want to maintain supplemental insurance if I were on Medicaid?

For more information, click here

To see income limits, and other Medicaid eligibility criteria by state, click here.