I am having trouble verifying my identity on Healthcare.gov?

People are having trouble getting through to Experion. Here are some alternate phone numbers for them.

I am having trouble verifying my identity on Pennie.com?

If you do not have a credit history, the Experion cannot verify you. You can call Pennie and directly upload documents that they can often manually approve immediately, or if you proceed with the application there will be an opportunity to verify documents at the end, which may take a day or to.

I am trying to set up a Healthcare.gov account, but I never receive the confirmation email?

Make sure your email address does not include a hyphen.

If I fill out a non-financial application and later lose my job and revise my application to seek APTC, will I get tax credits retroactively for the earlier months?

I don’t know. To be on the safe side, fill out a financial application with a high income.

Can my children under 26 be on my Pennie Application?

Adult children under 26 who file their own taxes may choose to be included on their parents’ application or submit their own application, whichever is more advantageous.

I am married but separated. What should I do?

If you are legally separated or you are unmarried for tax purposes (this is the case with some foreign nationals whose spouses live outside the United States), then select “not married” on your application. Also, if you have been abandoned by your spouse, you may answer that you are “not married.”

According to the Kaiser Family Foundation, “if you expect to be divorced by the end of the tax year, you will be able to file as a single taxpayer for that year and could qualify for subsidies under that filing status when you file your taxes. However, you may not be able to receive all of the premium tax credit that you’re entitled to in advance if you are not yet divorced when you make your Marketplace application. Except in cases of domestic abuse or spousal abandonment, you should not say on your application that you are unmarried when you are still married.” This is ambiguous. If you do not apply as single, you should be able to apply as married and planning on filing jointly. If your spouse doesn’t want to cooperate and you are still married at the end of the year, then his or her income could impact your APTC repayment.

If you have a dependent and meet certain conditions, you may be able to use the “head of household” filing status. People who file a tax return using this filing status can qualify for premium tax credits.

I believe I should get tax credits but they are not being offered. What should I do?

There are situations where tax credits are not offered, such as for people who have an affordable offer of insurance through a family member’s job, or people who are married but file separately. There is probably nothing that you can do about such a situation. However, sometimes there are glitches in the system. For instance, there was a time when stating that you have never received Advance Premium Tax Credits (APTC) would bar you from receiving tax credits, which should not be the case. The temporary remedy was to state that you had received APTC and had reconciled them.

What is considered an eligible immigration status?

For information on Immigration documentation types, please refer to this page.

I am having trouble verifying my identity on Healthcare.gov?

status and the Marketplace, please refer to this page.

I am having trouble getting my income verified by Pennie. What should I do?

Pennie has become excessively strict regarding income documentation. They want documentation that shows the figure you estimated on your application, plus or minus $6500. The problem is that on the application you are projecting what your income WILL BE for the COMING YEAR, whereas whatever documentation you have is likely to be what it WAS during the PAST YEAR. Previously Pennie accepted a signed self-attestation regarding your income for the coming year, but those are not being accepted the way they used to. Call me at 412-736-4600 if you have additional questions.

If I do not estimate my income correctly, do I have to pay back all my excessive tax credits?

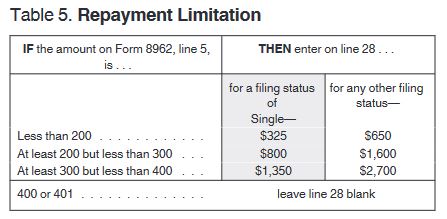

In principle, there is a truing up of your tax credits when you file your 1040. In practice, you often do NOT have to pay all of your excessive tax credits back. If you are below certain percentages of the Federal Poverty Level, your repayments are capped by the IRS. However, the Big Beautiful Bill repeals these repayment limitations starting with tax year 2026, so the full amount of excess Advance Premium Tax Credits will have to be repaid unless congress otherwise reinstates them.

Will I lose my tax credits if my income goes up or down?

From time to time, such as when Pennie automatically renews someone for the new coverage year, they will access IRS and other data to confirm you income. If the data they access is 40% above or below the amount stated on your application, or it is $20,000 more or less than the amount stated on your application, you can lose your tax credits.

How do I remove one family member from a Pennie policy without removing other members?

Edit the application, specifying which members are seeking coverage and which are not. This will remove the person no longer needing coverage at the end of the month, so you cannot do this more than a month in advance. In the case where no other family member needs coverage, you can simple use the “Disenroll From Health Plan” button, which gives you a choice terminating at the end of any of the next three months.

If I choose loss of other coverage as my event, will I have to supply documentation?

Probably not. For a list of required documentation for Special Election Periods, please refer to this chart.

Why am I not seeing questions about HRAs and job-based coverage in the application?

Probably the application has already determined that it is going to send your information to Medicaid.

I am going to change my UPMC Advantage policy mid-year. Will the deductibles I have paid towards my silver plan be applied to my gold plan?

Yes. UPMC will apply deductibles from one plan to another as long as they are in the same segment of the industry. (i.e. Medicare, Obamacare, etc.)

I am unemployed this month but had income in previous months and expect to make more than 138% of FPL for the full year. Will Pennie send me to Medicaid?

Most likely yes.

What changes did the Big Beautiful Bill make?

Non-citizens will be subjected to the 5-year bar for APTC starting in 2027.

Non-citizens ineligible for Medicaid will no longer be exempt from the requirement to have an income of more than 100% FPL in order to receive APTC starting in 2026.

APTC repayment limitations have been removed starting in 2026.

How do I earn Social Security credits and how many do I need to be eligible for benefits?

Social Security uses your total yearly earnings to calculate your Social Security credits. The amount needed for a credit in 2026 is $1,890. The amount needed for a credit in 2025 was $1,810. The amount needed for a credit in 2024 was $1,730. You can earn up to a maximum of 4 credits per year. The amount needed to earn 1 credit automatically increases each year when average wages increase.

What are health savings accounts (HSAs) and how do they work?

Here is a good link to an explanation from Fidelity

I am newly married. What kind of documents to I need to submit to Pennie for a Special Election Period?

Marriage

To qualify for this SEP, you must provide documentation verifying your marriage and the date of the marriage. You will also have to verify that the person(s) who experienced this life event had coverage for at least 1 day in the 60 days prior to the date of marriage. Below is a list of documents you can provide. We will review these documents and notify you when a determination has been made.

1.

Proof of Marriage

Choose any 1 document below

Marriage Certificate or License

Marriage affidavit or signed and dated affidavit of support by officiant or official witness

Religious document showing who got married and marriage date

Official public record showing who got married and marriage date

2.

Proof of Prior Coverage

Choose any 1 document below

Private Insurance

Government Heath Program (Medical Assistance (Medicaid), CHIP, Medicare, TRICARE, Veterans Affiars, Peace Corps)

Employer-sponsored coverage, including COBRA

Pay stub showing deduction for health coverage

Insurance purchased through another state’s Marketplace

Student Health Coverage